Doing ETF analysis

Stocks you probably already know, and you may have heard the word ETFs as well. Exchange-traded funds (aka: ETFs) are booming: more and more investors are putting some of their money into this innovative category of investments. New ETFs are offered every day on the world’s major exchanges. In this article we answer the question; how do you buy an ETF? and what factors do you pay attention to when buying an ETF? Doing an ETF analysis is how you do it.

Psst: Is ETF investing new to you? Then read this article first!

ETF analysis

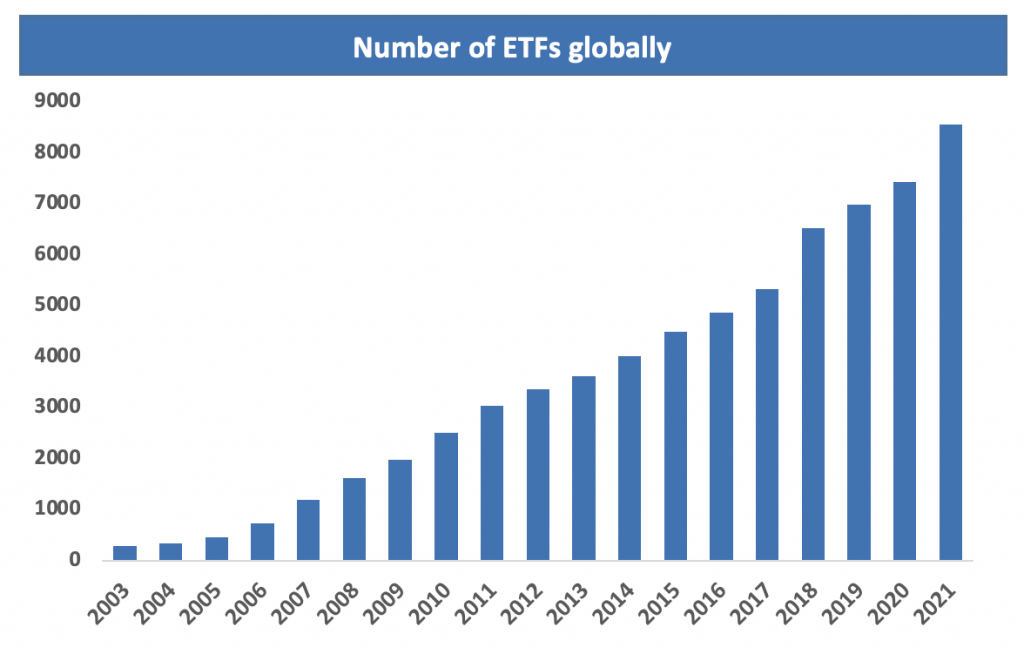

The number of ETFs worldwide has grown substantially in recent years, and all indications are that this trend is likely to continue in the future. We get that, because ETF investing is kind of easy.

Ps: are you new to the world of investing? Sign up for the free roadmap “discovering investing in 5 steps” for free!

If you are also interested in ETF investing, you may be wondering what criteria you should use when buying an ETF. After all, there are so many, and what exactly should you look for? Although ETFs are relatively simple investment products and are suitable for all types of investors, you still need to choose carefully: after all, you want your investments to match your financial goals! In this article, we are going to help you and explain “how to buy an ETF? When buying an ETF, there are a number of factors to pay close attention to. We are going to cover them step by step.

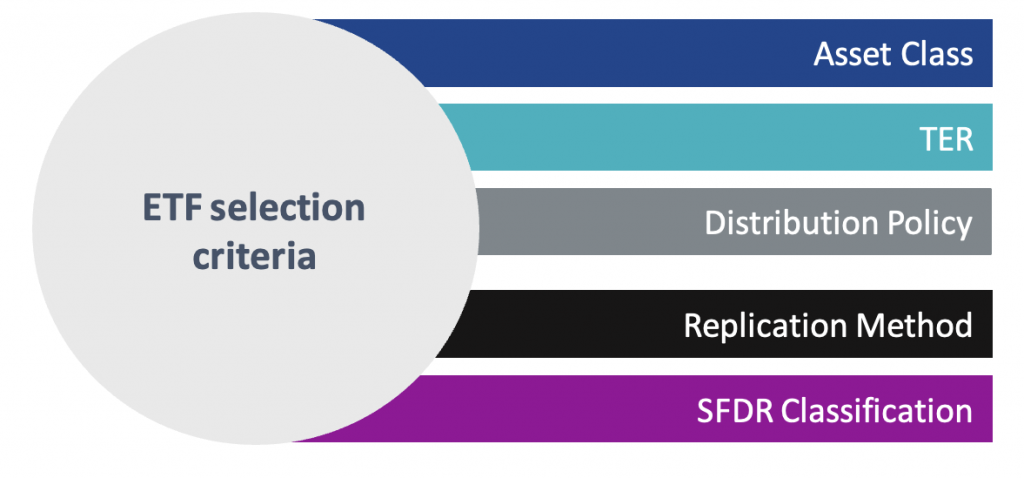

An overview: key factors

Before we cover each point in detail, here is an overview of the most important factors you should pay close attention to. Never fear, further on we explain in easy language exactly what everything means and how you can get started with it!

Asset class

For an investor, the first step is to understand which asset class you want to invest in. This depends primarily on your specific risk preferences, which play an important role. Want to discover how to determine what your investment strategy could be? Then take a look at our e-course Starting to Invest where you learn all about risks and how to create a personal plan.

Diversified, or: well-diversified investment portfolios have exposure to different types of investments (not betting on 1 horse, logically), to reduce risk without sacrificing financial returns. See, that’s what we want!

ETFs can be classified as equity, fixed income or multi-asset. The former provide exposure to stocks, the latter track the performance of bonds, and the latter allow for investment in different products (i.e. stocks AND bonds) in a single solution.

Equity ETFs, for example, can be classified into the following categories:

- Geographic: provide exposure to specific areas or countries of the world

- Real estate: enable investments in the real estate sector

- Commodities: these ETFs replicate the performance of companies involved in the extraction and processing of commodities

- Thematic: they have developed significantly in recent years and follow certain trends or investment themes. For example, check out the article on investing in the gaming industry here.

Bond ETFs mainly belong to the following three groups:

- Corporate bonds: these ETFs invest in bonds issued by companies, with a choice of different ratings and thus risk levels

- Government bonds: they invest in bonds issued by sovereign states

- Emerging market bonds: they follow emerging market bonds, which typically offer higher yields but also higher risks.

Multi-asset ETFs invest in a mix of the above, providing a one-stop shop for diversified investment portfolios. In Europe, the value of the ETF industry is currently just over $1.2 trillion¹, the majority of which are equity ETFs. Then bonds and commodity-oriented funds follow.

TO

By the expression “TER” we mean the “total expense ratio.” That means: the annual fees an investor faces when investing in an ETF. This amount is paid to the ETF issuer and serves as a fee for operating the fund. Thus, the TER should be viewed as the portion of the investment that is deducted as an expense each year. It is important to note that this rate is not calculated on the initial investment, but on its value over time.

Typically, costs range on average from about 0.15%-0.20% for the cheapest ETFs to 0.70% to 0.80% for the most expensive. Costs are very important to consider when investing. In addition to the TER, it is also good to look at the fees your bank or broker charges for purchase orders.

ETF distribution policy

Another element to watch out for is the ETF’s distribution policy. In plain language, if an ETF pays a dividend, is it paid to you or is it automatically reinvested? ETFs are defined as distributing or accumulating, depending, of course, on whether an ETF pays dividends.

If you want to invest in a product that pays dividends, you can choose a dividend-paying ETF to receive regular payments. If you primarily want to let the compound interest effect do its work, you can choose ETFs that automatically reinvest dividends.

Replication method

How is an ETF made? An ETF must be created by a provider, and how this ETF is constructed is important. This is called the ETF’s replication method. An ETF can be replicated physically or synthetically,.

In the first case, with full physical replication, the fund actually owns all the securities in the underlying index it tracks. In synthetic replication, an ETF can track the value of the underlying stocks through derivative contracts such as swaps. In that case, investors are exposed to greater risks; derivative contracts such as swaps involve third parties, creating what is known as counterparty risk. In times of stress in the financial markets and the economy in general, these risks become even greater.

Synthetic replication represents only one of the risks of ETFs. It is very important to be aware of that. More information can be found here: What are the risks of ETFs?

Size of the fund

While not extremely relevant, it can still be useful to analyze the size of the fund in terms of assets under management, as well as how long it has been active. Indeed, these two indicators can provide insight into the degree of success of the fund’s investment strategy. Currently, the largest ETFs, which often replicate the most popular indices or broad segments of the global stock market, have assets under management in excess of USD 100 Billion.

Another reason why the size of the ETF, i.e. how much assets are invested in it, is because then it is a successful ETF for the creator. The more successful the ETF, the less likely the plug will be pulled. Of course, you don’t want that, just when you’ve chosen an ETF and started investing!

SFDR Classification

Recently, more and more investors have been paying attention to the sustainability of their investments. About time! The recent European Sustainable Finance Disclosure Regulation (SDFR) requires fund managers to publish comprehensive ESG data on the investment products they offer.

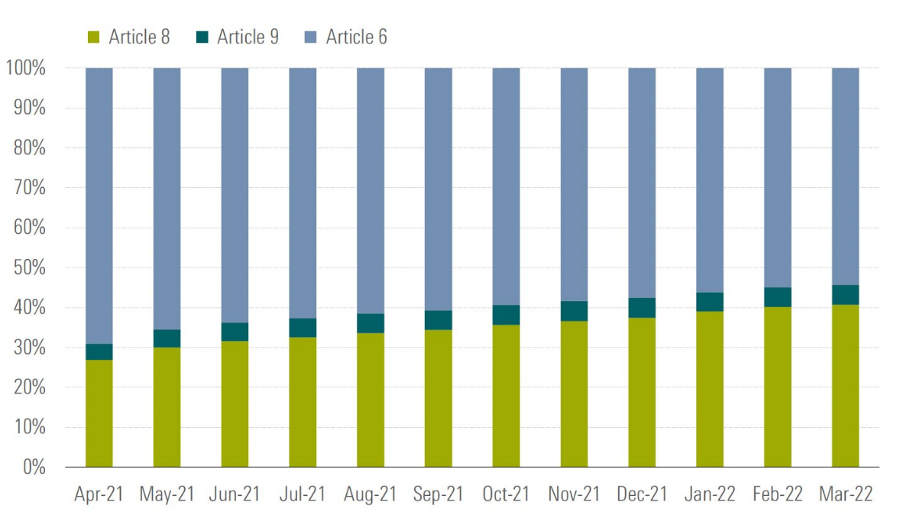

There are three possible classifications ETFs can receive based on their degree of sustainability and ESG filters:

- Article 6: Funds without a sustainability policy or objective

- Article 8: Funds promoting environmental or social characteristics.

- Article 9: Funds with an explicit objective of sustainable investment

Below is the evolution of the number of ETFs classified according to the three articles of the SFDR, from April 2021 to March 2022.

It is clear that investors for whom the sustainability of their investment plays an important role will focus primarily on Article 8 or 9 funds.

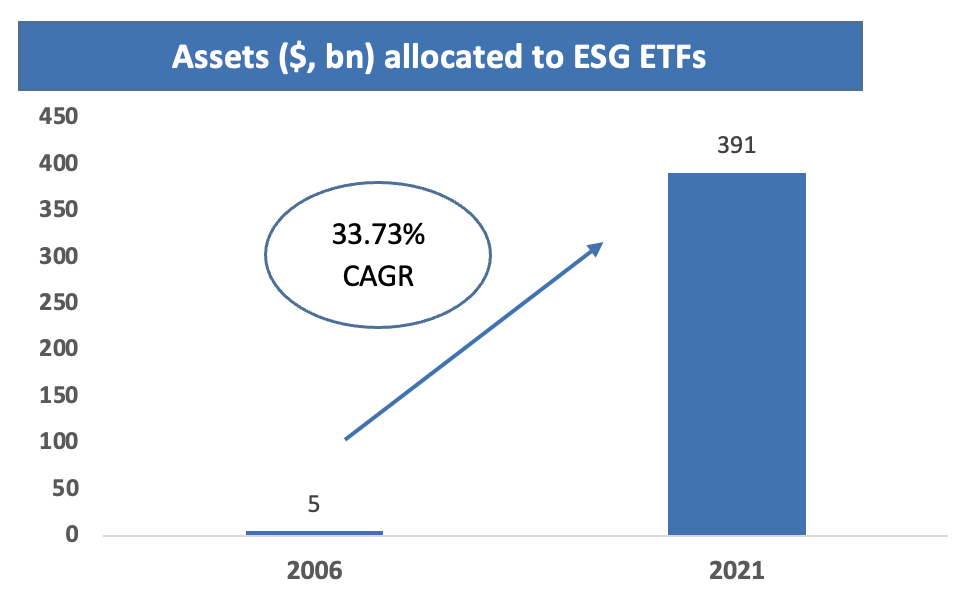

The following chart shows trends in the value of assets allocated to ETFs that incorporate ESG objectives into their investment strategies, according to data from Statista. As you can see, a lot more money is now invested in products that have sustainability aspirations.

And now?

By now you know which 5 factors are important when choosing an ETF. But really, we need to take another step back: is ETF investing even for you? Does ETF investing fit into your strategy? To do this, it is important to discover what the world of investing can offer and what form of investing suits you. At elfin, we want to urge you never to invest with money you can’t afford to lose. And then when you start investing: choose a way and a product that suits you and your goals!

Want to discover more about how to work toward your financial goals? As an Elfin member, we help you discover in 5 steps how to become financially independent. Within these 5 steps, discovering what investing is is 1 of them! Be welcome and join hundreds of other women.