2 Investment trends in 2023

2022 was not the best year for investors. In this article, we discuss 2 investment trends in 2023 and look ahead. Read along quickly. By “investment trends,” we mean investment themes that are attracting the attention of more and more investors. Trends that are taking serious shape. Anyway. Here we go!

This article was written in collaboration with VanEck. This article is for educational purposes only and has no commercial interest for elfin. Know that investing has risks and only invest with money you can afford to lose!

Psst: In this article, we go into depth. Are you a novice investor, and would like to first learn about what exactly investing is? Take our approachable e-course Beginning to Invest.

2 Investment trends in 2023

In 2023, we see roughly 2 major trends:

- technology

- renewable energy

Read on quickly about these 2 investment trends!

What do we mean by investment trends?

By “investment trends” we mean all investment topics that are attracting the attention of more and more investors and taking on the characteristics of real trends. Trends that are growing in both popularity and prominence in the world of finance.

Consider, for example, the megatrend of investing in electric vehicles or renewable energy. But also Blockchain and Cryptos, Semiconductors, Strategic Metals and Metaverse. Just to name a few.

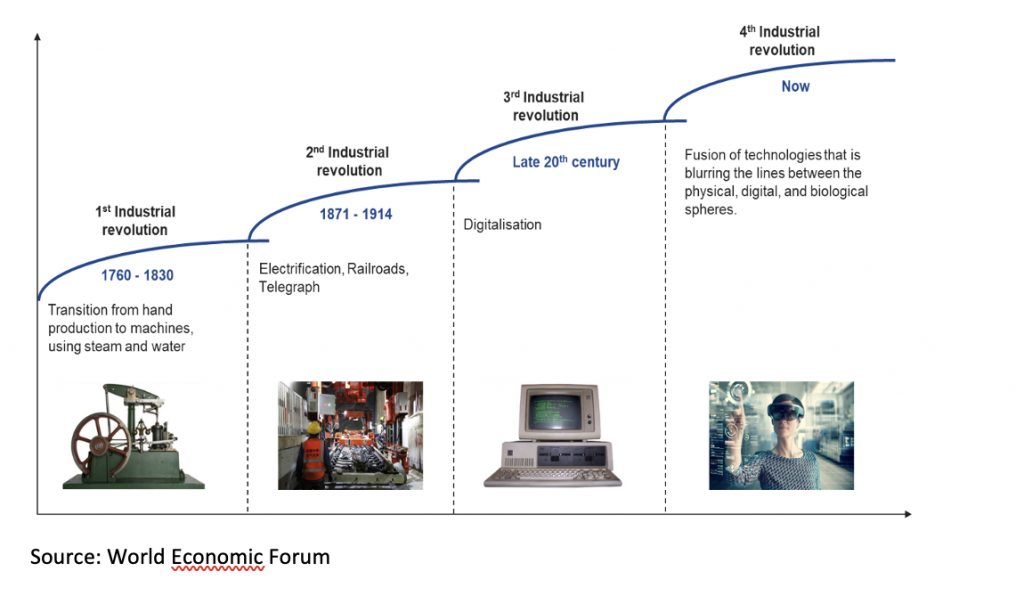

These are high-impact topics. These are topics that we can expect to affect or dramatically change our society. Just think how digitalization, and big tech (facebook, meta, amazon, microsoft, etc.), has affected our lives. And not only that: it also created great investment opportunities. characterized by potentially high growth and constantly new opportunities.

How do you discover investment trends?

Banks, brokers and asset managers try to keep all investors informed about investment trends. They also play to their full advantage here. Just think of the brokers like BUX Zero that was going to offer investing in cryptos in 2022. Or ETFs, which have become hugely popular in recent years. They try to be the first to notice new trends. But that’s not all, they also want to quickly create products that allow investors to capitalize on the latest trends.

And it is precisely the Exchange Traded Funds (ETFs) sector that has experienced very strong growth in recent years, because ETFs are very well suited to investment trends.

Why? It would become very complicated, having chosen a trend theme (such as video, energy or food), to invest in every involved company operating within this trend. An ETF that invests in a combination of companies. Because of this, if you want to follow an investment trend, an ETF often allows you to follow many companies active within a particular trend with 1 investment.

Need to brush up on your knowledge around ETF investing? Then read this article!

What investment trends are emerging?

Trend 1: technology

At the top of the list is undoubtedly technology. Indeed, there is an increasing emphasis on digitization and major technological developments are taking place.

There are many ETFs that fall into the technology category. Within the tech category, you again have subcategories.

Popular in the technology category are:

- Microchips are a category of metals with very special and unique properties that lend themselves perfectly to making these small and very fast computers. They perform huge numbers of calculations in limited time intervals and can store large amounts of data. There are numerous application areas, from artificial intelligence and mobile communications to 3D printers. ASML is a Dutch company that is a world leader in this.

- Video games and e-sports. This is a fast-growing sector that, especially during the height of Covid, reached the highest levels. Learn more about video gaming here. This is an ETF where you can invest in video gaming.

- Play-to-earn: Play-to-Earn is a fairly young branch within gaming. In this, it becomes possible for gamers to earn money directly from a game, i.e., not through tournaments or content creation, but directly by playing the game.

Trend 2: renewable energy

Another trend is renewable energy: a global trend supported by most governments in developed countries.

One of the possible forms of energy of the future, besides solar and wind, is hydrogen. There are currently three types of hydrogen, depending on how it is produced: gray, blue and green hydrogen.

Green hydrogen is the most sustainable version because it is produced with renewable energy. In the coming years, the cost of green hydrogen is expected to drop significantly.

Interesting! Through this ETF, you can invest in renewable energy.

But note that there is no guarantee that hydrogen will be the main, or major source, of renewable energy in the future. In the meantime, new resources may be discovered or unexpected events may occur.

The possible applications of this trend include aircraft, trains, trucks and all kinds of factories. It enables investment in 25 companies that derive revenue from the area and is composed of companies worldwide.

Summary: the 2 investment trends in 2023

The term investment trends is used to distinguish investment themes that are currently most fashionable and attracting the attention of more and more investors. The 2 investment trends for 2023 in the world of stock market investing are around technology and energy. Are you capitalizing on trends when it comes to your investments?