Investing in gold

Who doesn’t love gold? In addition to shining beautifully and looking nice on your finger, it is also an excellent investment. Did you know that gold has had value for more than 6,000 years? We can’t say that about many things. Since it holds its value, does not oxidize and is very rare, it can be an excellent addition to your investment portfolio.

This blog was written in collaboration with GoldRepublic. This is a paid content collaboration. There are no affiliate links in this article.

Investing in gold

People often have no idea how big a kilo of gold actually is. As shown above, a kilo of gold is about the same size as an iPhone X – only there is a slight difference in the weight (& price of course). Indeed, the iPhone weighs 174 grams, making it more than 5 times lighter than a kilo of gold, while the size is about the same. The price of a kilo of gold is worth about €59,000 today, watch live gold prices.

Now that you have a bit of an idea about the product, let’s go over the purchasing power of gold under the microscope. Let’s contrast gold with a product that people around the world are familiar with – the Big Mac from McDonald’s. In 1980, you could buy this world-famous burger in New York for $1.70, which at the time was equivalent to 0.1 grams of gold. Today, a Big Mac in the “Big Apple” costs $6.50, which again now represents about 0.1 grams of gold. For the same gold, you buy the same Big Mac 42 years later, only the dollar price has almost quadrupled.

Hedge against inflation

In the previous example, we showed that gold retains its purchasing power, and thus is a “hedge” against inflation. Let’s discuss another example, but one on our own territory, in the Netherlands. The average price of a house for sale in the Netherlands in 2002 was €200,000, and the price of gold then quoted at about €10,000 (per kg). So you needed 20 kg of gold converted back then to buy an average owner-occupied house. The average transaction price for a house for sale in the Netherlands reached €394,000 in the first quarter of this year (2023), nearly doubling in 21 years. A kilogram of gold stood at about €57,000 per kilogram in the first quarter. This means that one can now buy an average owner-occupied house for an equivalent of 7 kg of gold. Thus, the precious metal not only retained its purchasing power, but actually gained nearly three times its strength compared to 2002.

Rarity

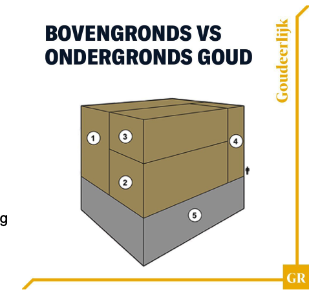

Enough examples about purchasing power. Let’s look at another property of gold, rarity . How rare is gold really? In the picture below, you can see a gold cube of 22 meters per side, divided into 4 blocks. Also see a little man next to block 4, to indicate how big the cube actually is. Herewith the categorization of all above-ground gold, indicated in tons (source: World Gold Council (Dec-2021).

1. Jewelry ~ 94,464t (46%).

2. Bars and coins ~ 45,456t (22%)

3. Central banks ~ 34,592t (17%)

4. Otherwise ~ 30,726t (15%).

5. Underground ~ 53,000t

Some 53,000 tons are hidden in the earth’s soil. How long it will take mining companies to get it out of the ground remains a mystery. But that it is becoming increasingly difficult is a fact.

Rare it certainly is, for a cube of 22 meters per side is not that big. Therefore, this is also one of the reasons people like to invest in something that is not simply “printable” like currency.

Fun fact: the European Central Bank has axed €1,365,742,000,000 in the year 2020! This has caused inflation to skyrocket in recent years. Why save something they can reprint at the touch of a button?

Distribution

To bet entirely on one horse does not seem wise as a good investor. Practice shows that investors often have a rule of thumb, which has to do with investing in gold. They choose to invest between 10-20% of total invested assets in gold. Besides spreading risk, there is another reason behind this percentage. We can now say that gold is doing well when the world is doing a little less well. During high inflation, war, crisis or other stresses in the financial world, investors seem to flee to “safe-haven” investments, such as gold. Let’s take the most current example. Gold rose 10% from March 1, 2023 to May 1, 2023 (2 months). This has everything to do with the banking drama in the United States. After Silicon Valley Bank went bankrupt in early March, several banks ran into trouble shortly thereafter. Customers took massive withdrawals from the bank, resulting in a so-called bank run. Because of the panic on the news what came out of this, investors seem to be opting for hard assets , such as gold (& silver) and have less and less confidence in the dollar.

Return on investing in gold

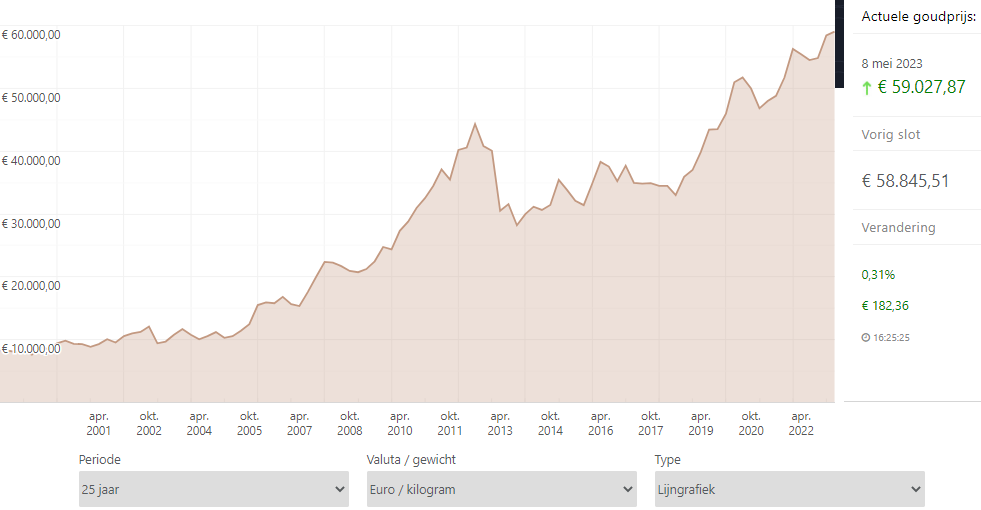

Show me the numbers, you must be thinking! Read along: Since 2001, gold has averaged a 9% annual return. The savings rate now stands at about 1% at Dutch banks – which of course is disproportionate to inflation: 5.2%. Savers in recent years have increasingly felt like doing “something. Stocks, bonds, cryptocurrencies, real estate. There are countless ways to invest your money. But what feels best? And what makes you sleep best? Gold is seen by many as an extremely “boring” investment. Rather, we see it as a stable investment that you don’t have to constantly check. Financial peace is an important issue, which is also taken very seriously at GoldRepublic. See below the course of gold prices since 2001.

Silver

In addition to investing in gold, GoldRepublic also offers other precious metals. Silver is a lot cheaper, at about €750 per kilo. It is considered an industrial good since it is widely used in industry. It is a very good conductor of heat and is therefore widely used in electronic devices. ‘Anything that has an on and off button contains silver’. The price of silver is a lot more volatile than the price of gold. When we contrast these two precious metals, we notice an interesting relationship. The gold:silver ratio now stands at 77 – meaning you can exchange 1 kg of gold for 77 kg of silver. In other words, gold today is 77 times more expensive than silver. At the beginning of this century, this ratio still stood at 55. There are so-called ratio traders who exchange gold for silver, or vice versa, based on this gold:silver ratio. The higher the ratio, the more expensive gold is, from a silver perspective – but also the cheaper silver is, from a gold perspective.

In short, silver is in solar panels, electric cars, computers and smartphones. For those who think these products will become important in the future, silver is a potentially nice investment in the long run. View live silver price

Platinum

Finally, GoldRepublic also offers platinum, which is about €31,000 per kilo. Platinum is somewhat less popular these days, only it has been different before. In the artist world, a “platinum record” is the highest award attainable. But gold is more expensive, right? So why is a gold record not the highest attainable? Prior to 2011, platinum was more expensive than gold. Some investors believe that platinum will one day become more expensive than gold again, and so decide to buy platinum. Among other things, platinum is used in jewelry, catalysts and in devices that must withstand high temperatures. It is also considered a good investment since platinum is still much rarer than gold. As mentioned earlier, all the above-ground gold fits into a cube of 22 meters per side. All the platinum ever produced fits into a cube of only 9 meters per side.

Tips for investing in gold

Finally, if you decide to put some of your invested wealth in precious metals, we have a few tips. At GoldRepublic, you can easily create an account, and make a purchase through the website or app. In the purchase process, you choose a vault where you want to store the precious metal so you don’t have to do this yourself. For a small percentage per year, your bullion is safe with a reputable vault custodian in Amsterdam, Frankfurt or Zurich. Fine idea! You don’t pay VAT on gold – but silver and platinum do. In Zurich, the precious metal is in a bonded warehouse, which is a piece of no-man’s land. This makes it possible to “avoid” VAT on silver and platinum. As long as you leave the precious metal neatly within these vault walls, you don’t pay VAT!

Strategies

You can choose to invest a large amount at once, with the long-term vision. It is also possible to use the “Dollar Cost Average” strategy. This way, you buy a piece of bullion every month, spreading the purchase price over several times. GoldRepublic has a savings plan for this, where savers save a piece of precious metal completely automatically, every month. Cancellable monthly, starting at €50!