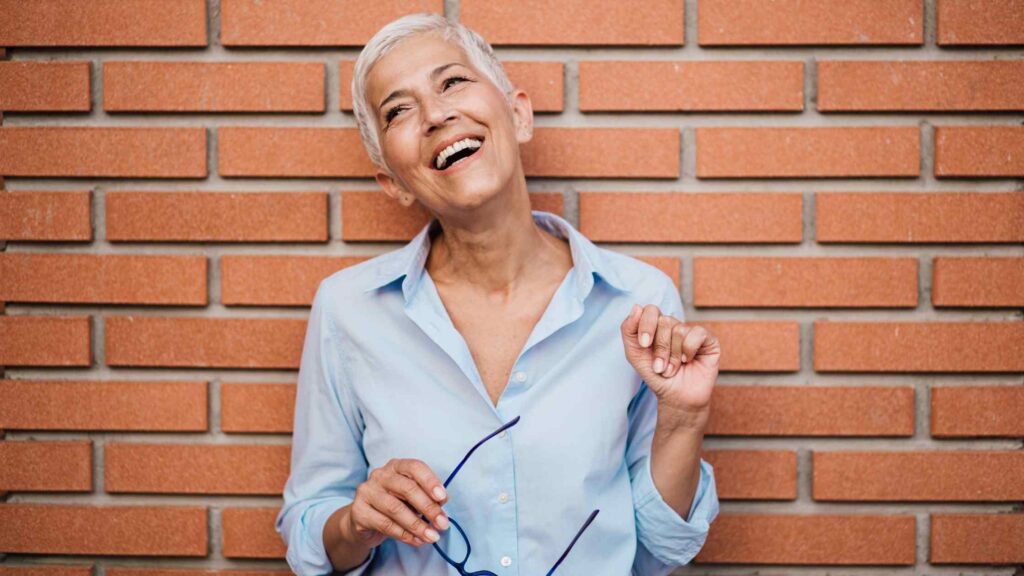

Investing when you’re 50, does it make sense?

“Hi ELFIN! I have a question. I am 55 and don’t fall in your target group I think. But does t still make sense to invest at this age? I don’t know anything about it, I took an online course once and read books, but I just can’t seem to take the plunge. I don’t want to make a profit in 30 years. So have been doubting for at least a year and haven’t taken a step yet. What to do?” This question landed in our inbox. And this was not the first time a woman 50+ has wondered if there is still a point to investing. In this article, we share our views. Investing when you’re 50, does it still make sense?

First of all.

50 is the new 30. Right? Don’t be fooled into thinking you are “too old” for anything.

Second.

50 you are, or almost, or already have been. But 60 you’re going to be anyway. 70, 80 and 90 probably too (we wish you that, a long life in good health). What we are trying to say: time is going to pass anyway, whether or not you are going to invest/travel/get a new education/date/start your own business.

So are you 50 now, and in doubt about whether to invest? The next few years will pass anyway, that is a given. Either you do choose to build up that extra pot, or you don’t. Don’t let age be an impeding factor to still do something smart with your money.

Now for the facts: investing at 50, does it still make sense?

Investing has the goal of future financial gain. Repurposing your money on the assumption that it will become worth more. You will learn all the basic rules of investing in ELFIN’s online e-course Starting to Invest, part of the membership. It is very important to realize that with investing, therefore, you want to gain financially, and absolutely not lose money. People – especially young people – often forget this. They start speculating in crypto currencies, thinking they can select the right stocks you and trade far more often than is good for them. But when you are young you have 1 advantage: you have a long time to make up losses. If you lose €10,000, you have about 30 years to regain that. You can manage that. But when you’re 50, you ab-so-lutely don’t want to lose money! Investing when you are 50 certainly still makes sense (100% a YES), but it requires an even more cautious approach than when you are young.

Video tip! Watch this video in which VanEck CEO Martijn explains why it definitely makes sense to invest if you are 50+!

The golden investment rules

When it comes to investing, there are 3 golden rules to live by:

- spread your investments

- keep your costs as low as possible

- Be in the game for at least 10 years

Spread your investments

This is all the more important for ladies who are 50 or older. The wider your spread, the less risk. Read all about why spreading your investments is so important here. You can easily diversify your investments by investing in funds at Brand New Day, for example, or investing in very broadly diversified ETFs.

Keep your costs down

The lower your costs, the more money you have left over. Quite right, although many people forget this. Keep costs low by choosing the right bank or broker, by trading as little as possible and by not investing in foreign currency products.

Long-term

This is your only drawback: you don’t have 30 more years to let time do its work, let the interest-on-interest effect go through the roof and see your wealth increase by staggering amounts. Shit. But let’s stop fretting about “if only I had…”. Because: you still can!

Suppose you invest €200 every month from now on in a broadly diversified fund, at 8% return. After 10 years, that’s about (let’s say at age 60 you want to use this money, perhaps to work less, or take a nice trip) anyway: 200 * 12 * 10 * 8% = €36,000 (while initial deposit is 200 * 12 * 10 = €24,000). Still, that’s a difference of €12,000!

Risks

Of course, investing involves more risk than putting your money in a savings account. But as you’ll see in the math above, it can save as much as €12,000 over 10 years if you invest versus save. But even if you’re a little older, the following applies: invest only with money you can spare. So don’t siphon all your savings into the investment account.

Conclusion: Investing when you’re 50, does it make sense?

Yes. Provided you properly consider the risks. Make an informed decision about where to invest, and in which products. Time will pass by anyway, so why not build an extra pot of money? Become an ELFIN member and take our Beginning to Invest course to learn even more about specific risks, types of investment products and which investment party is right for you.

A reminder of the most important investment issues? Read more here!

See inspiring examples here of other elfin women around 50 who have also recently started investing!