What is dividend investing + tips for getting started yourself

In this article, we are going to talk about the question of all questions: what is dividend investing? Dividends are a way to generate passive income. Very honestly? By not investing dividends, you are leaving free money on the table! Yes, we really think so. Anyway, so time to find out all about this. We also explain the various options for receiving regular dividends.

Psst: In this article, we go into depth. Are you a novice investor, and would like to first learn about what exactly investing is? Take our approachable e-course Beginning to Invest.

What is dividend investing?

Dividend investing means investing in stocks that pay dividends every so often. Dividend is a distribution of a portion of a company’s profits. You as a shareholder of the company are rewarded, so to speak, for the trust you have in that company.

However, far fromall companies pay dividends, these are often companies that have been around for a long time and no longer want to reinvest all their profits for growth. These companies are also known as cash cows. These tend to be companies from the somewhat “older” industries, such as telecom, oil & gas and finance. In the Netherlands, these include companies such as ING, ASR, Randstad, PostNL, ABN AMRO and, of course, Shell. The food industry with Nestlé, Ahold Delhaize and Danone is also known for a steady dividend.

Dividend investing is also known as value investing. The great advantage of these value stocks is that they do continue to pay dividends in lesser stock market times.

In fact, dividend investing has 2 major advantages:

- Passive income, yes we love it!

- More return on your investments

Read on quickly and find out all about dividend investing!

Why do companies pay dividends?

Dividend investing is investing in companies that are accustomed to paying out a significant portion of their profits in the form of dividends. That’s basically a reward for you as a shareholder. You invest in the company and, as a “thank you,” you share in the profits. Often it is the more mature, stable companies with a proven history that have high dividend rates. Corporate profits are either reinvested in the company or distributed to shareholders. Both options have advantages and there is no right or wrong choice for the company. The main reason for keeping all profits within the company is to reuse them to invest in growth. Paying dividends among shareholders can be the main motivation to periodically reward investors for the risk taken and to increase the attractiveness of investing in a company.

Advantages of dividend investing

The benefits of dividend investing are even more apparent in times of (financial) uncertainty. Think inflation, marco economic turmoil and other factors that take their toll on financial markets – it is at times like these that it becomes apparent how valuable dividend investing can be. If you invest in dividend stocks, the stock price can still fluctuate so much, in most cases companies do continue to pay dividends. Also, dividend-paying companies are often proven stable: in fact, they make a profit.

Consider for a moment the popularity of growth stocks in recent years: these are companies that invest all the money back into the company for growth, and sometimes don’t even make a profit at all. That can make a company more vulnerable. If you invest in dividend-paying companies, you are dealing with mostly stable companies with healthy balance sheets.

Calculator

Of course, you want to know how much dividends can earn you. That depends on a stock’s dividend yield. Imagine you have 1 share of Elfin (think big ;-)) and this share has a price of €100. Elfin pays a 5% dividend yield each year. That means that with your investment, you will receive €5 per share each year.

But you are a fan of Elfin and have 10 shares, so you have invested €1000 in Elfin. At 5% dividend yield, you will receive €50 in dividends in 12 months. Don’t have to do anything for it. Hand cash (so approximate, tax rules apply, of course).

Efficiency

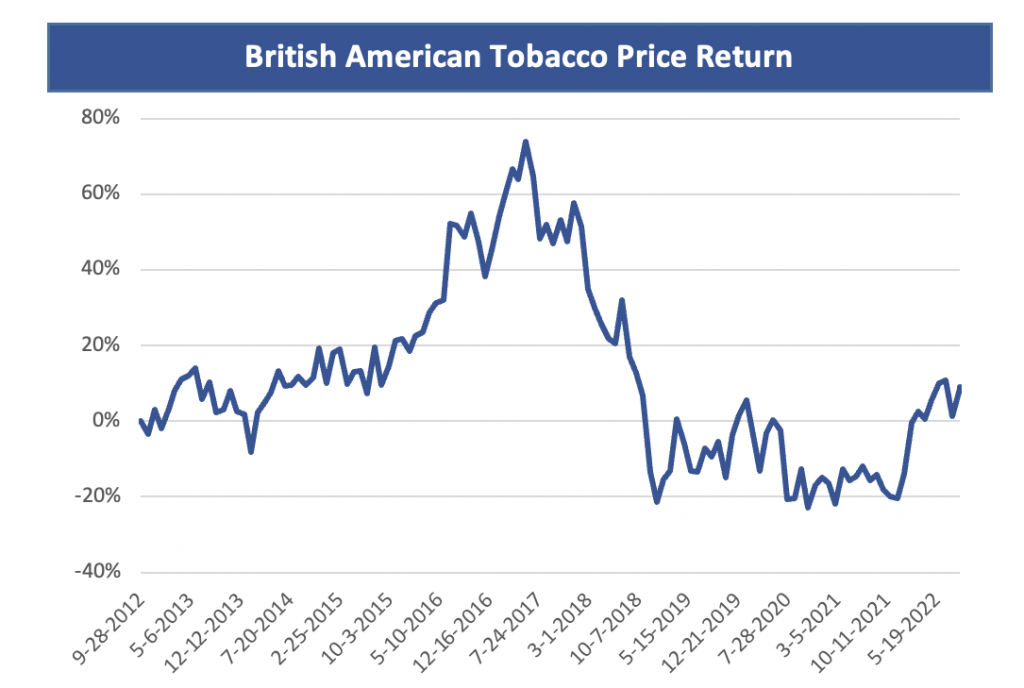

It is important to recognize how important dividends can be to an investor. Dividends can add significantly to the total return of an investment. The size of the dividend yield is variable and can also significantly increase the total return on the investment, especially when the stock price is not developing so well. The following example shows how the dividend yield can be influential. The following charts pertain to British American Tobacco(disclaimer: we are not a supporter of the tobacco industry, far from it, but this case demonstrates what we mean by “the impact on the total investment“), a British multinational specializing in tobacco products. The following chart shows the price return from Sept. 28, 2012 to Sept. 2, 2022.

Dividend influenced total return

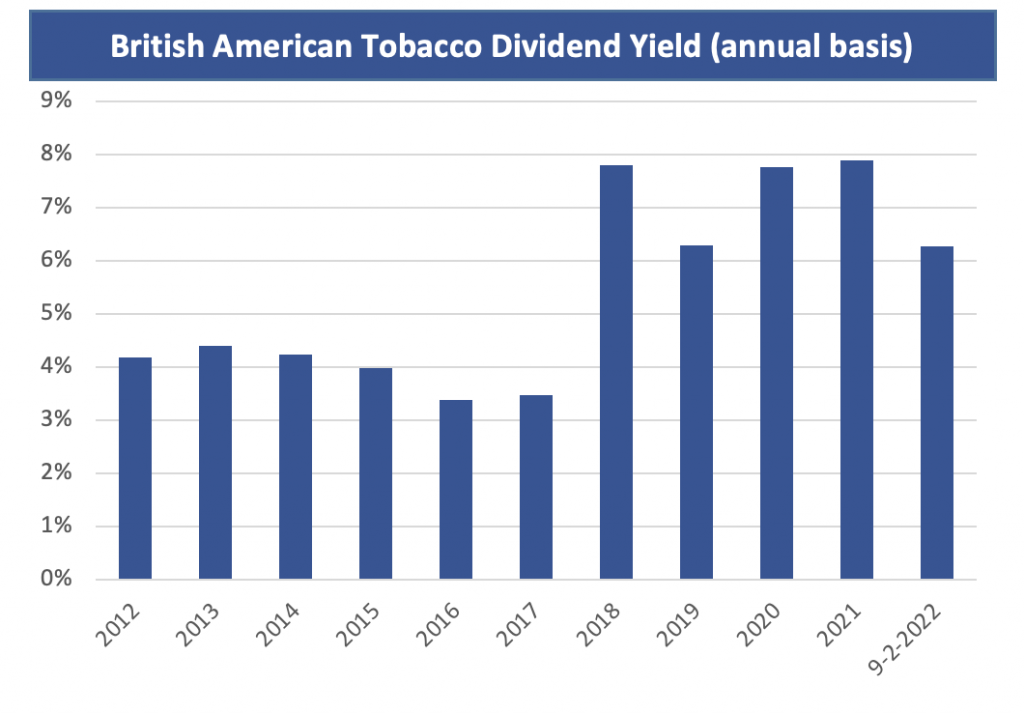

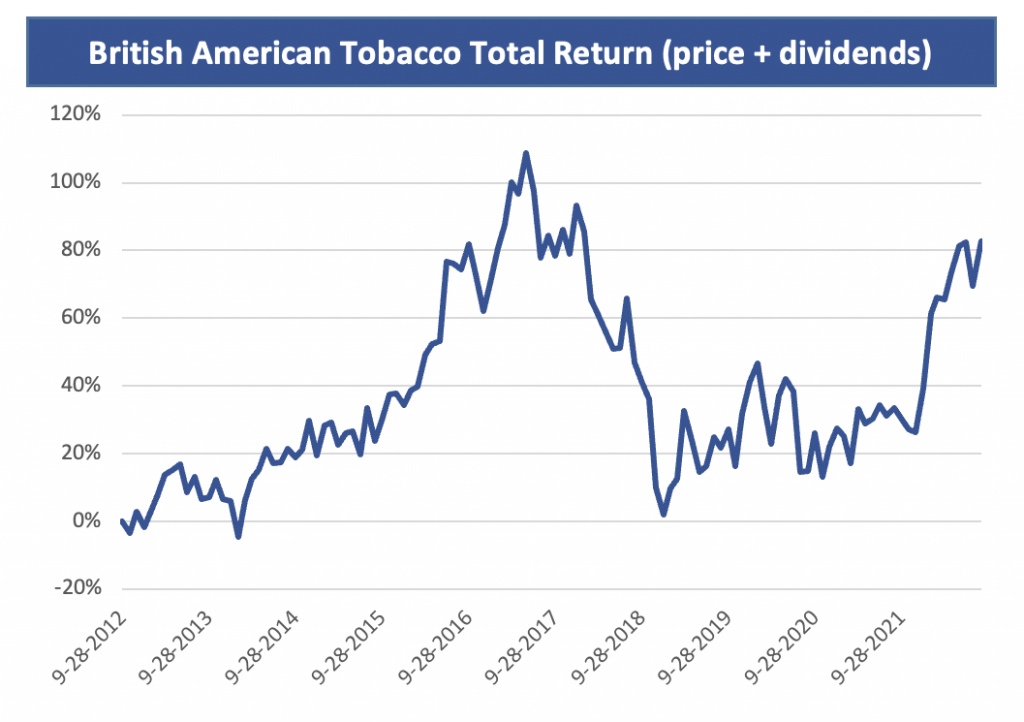

As you can see, the course is not much. If you had invested in this stock, and you would only profit from the price gain, you were not a happy investor. But the following two charts show how dividends can affect total returns. A fairly low stock price return was offset by a fairly high annual dividend yield. Because of these high dividends, the total return on this investment reached about 80%.

You can see in chart one the dividend yield, and chart two what ultimate effect it had on the return on your investment.

S&P 500 yield

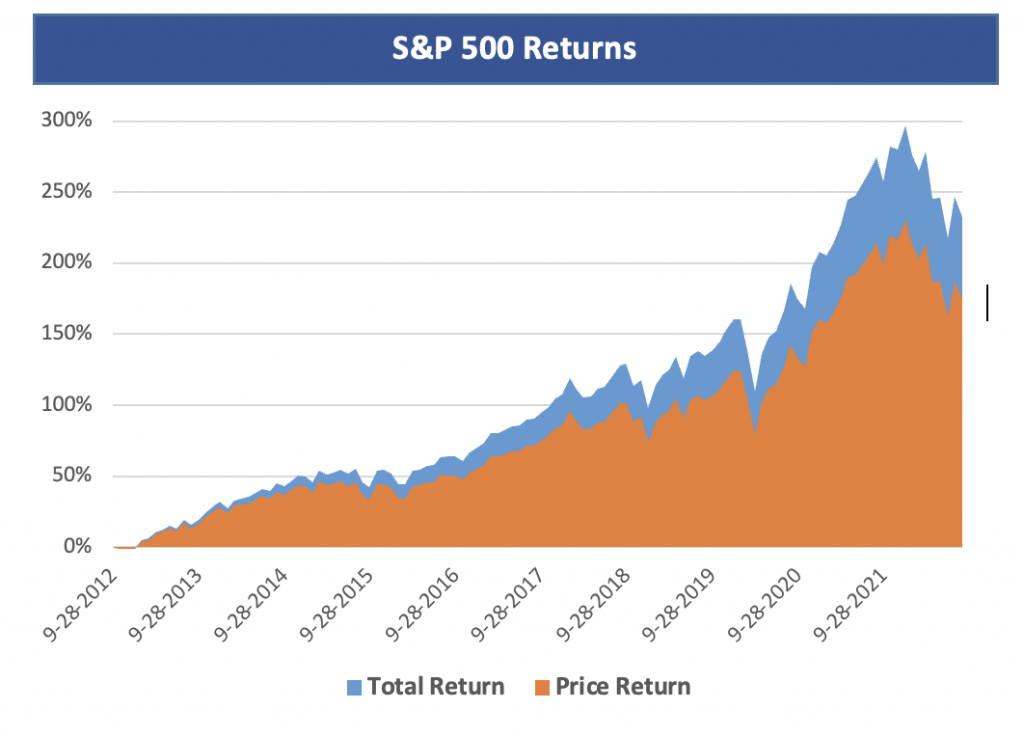

The same is true of the S&P 500. This is a large US index with the 500 largest companies in the USA. The total return (dividends + price) is much greater than the return on price alone. You can see that because companies in the S&P 500 pay dividends, the ultimate return to the investor is higher than if the investor had to rely solely on stock price appreciation.

How can invest in dividend stocks?

Okay, by now we know why dividend investing can be interesting! Passive income ánd more return on your investment. But how can you start dividend investing yourself? We now discuss 3 ways in which you too can start dividend investing.

- REITs

- High dividend yield stocks

- ETFs

REITs

REITs, called Real Estate Investment Trust in full, are special companies that own several properties (usually real estate), usually in different sectors, that provide constant and relatively stable income.

The most common business model of REITs is to rent out different types of properties and from this comes a stream of rental income. Depending on the type of real estate that certain REITs focus on, they operate in different categories: residential, healthcare, office and industrial sectors are some examples. Moreover, REITs are required by their specific legal structure to distribute at least 90% of their income annually in the form of dividends.

Psst: learn more about how to invest in real estate without buying buildings yourself here!

How do you invest in REITs?

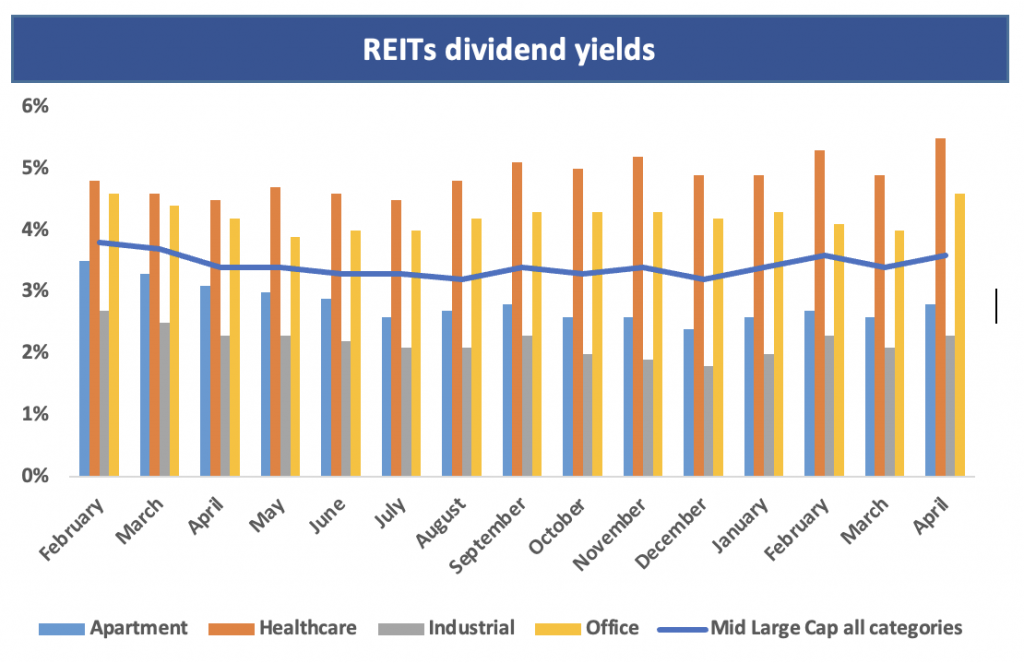

For example, you can access this type of investment through real estate ETFs. Van Eck has more information on these types of ETFs. The chart below compares the dividend yields of North American REITs by category. The timeline runs from February 2021 to April 2022. So you can see that you can receive between 2% and 6% dividend yield. For example, if you have €100,000 invested, that gives you between €2000-€6000 in income annually.

High dividend yield stocks

Not all stocks pay dividends. For example, the reason for companies not to pay dividends is that they are not yet making a profit, or they want to reinvest their profits in the company. There are companies, especially in certain industries, that are used to distributing profits. These are mostly companies with a high market capitalization and a proven history. Examples include companies in the banking sector or consumer goods. If you want to build a dividend portfolio, it is best to aim for investments in well-known companies that have already proven to make profits.

Dividend shares from the AEX in 2023

Dutch stocks that pay dividends include:

- Ahold Delhaize 3,35%

- ABN AMRO 9,01%

- Shell 5,61%

- ING 5,49%

- Randstad 5,58%

- KPN 4,75%

Outside the Netherlands, there are also many dividend stocks you can invest in. Think of companies such as Coca Cola, Deutsche Telecom, Nestlé, and more.

Read more about what types of dividend stocks there are here.

Where do you buy dividend stocks?

Dividend stocks can be purchased and added to your portfolio through DEGIRO or BUX Zero, for example. At BUX Zero, the advantage is that you can make free transactions, but they have a smaller range than DEGIRO. Read more about DEGIRO here.

Dividend giants

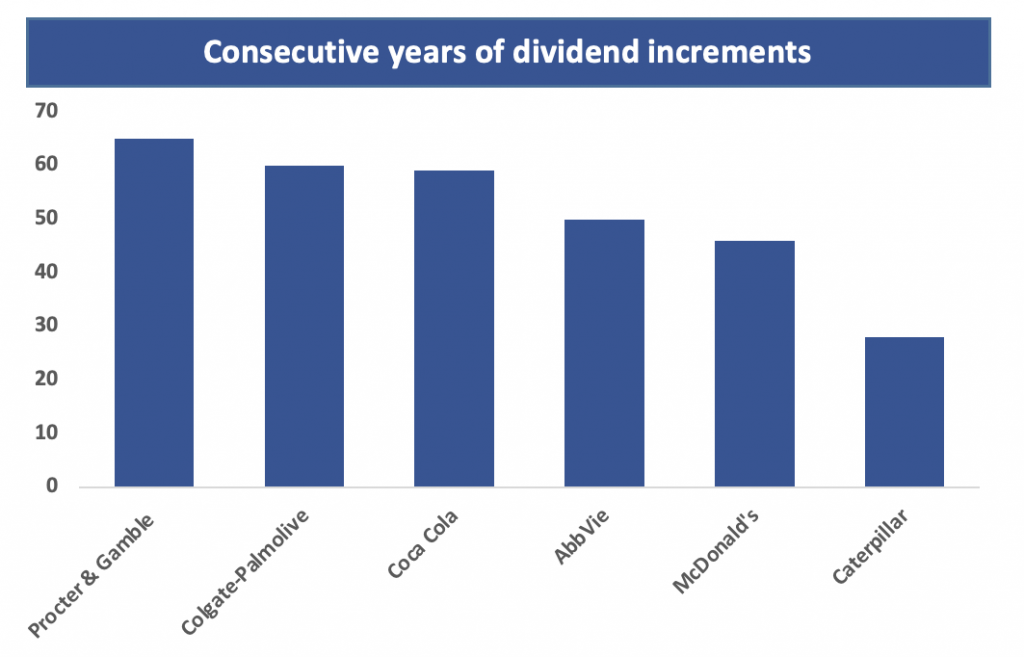

There are companies, so-called dividend democrats, that have raised their dividends for many years in a row. Procter&Gamble, for example, has raised its dividend every year for more than 60 years.

Dividend ETFs

Building a stock portfolio is quite tricky. There are thousands of stocks you can invest in, which one will you choose? Sometimes, then, an ETF is a good option: low-cost, broadly diversified investing. There are quite a few dividend ETFs available. But only a few ETFs are really based on the dividend idea. These ETFs, which make dividend payments their primary objective, are suitable if you do want to benefit from dividend investing without selecting and buying individual stocks. In general, all major issuers (think Van Eck, Vanguard, Amundi, Blackrock, UBS, iShares and more) of ETFs have at least one dividend ETF in their offerings. A dividend ETF is therefore a good way to engage in dividend investing with relatively low costs and broad diversification.

Some dividend ETFs are:

- Vanguard FTSE All-World High Dividend Yield UCITS ETF (ISIN: IE00B8GKDB10)

- SPDR S&P Global Dividend Aristocrats UCITS ETF (ISIN: IE00B9CQXS71)

- VanEck Morningstar Developed Markets Dividend Leaders UCITS ETF (ISIN: NL0011683594)

Some ETFs are distributive, that is, they pay dividends. When ETFs reinvest dividends, it is called “accumulating. Fact: If you look for an ETF and you see DIST in the name, you know they pay dividends. If it says ACC, then they automatically reinvest the dividend. Read more about ETFs and how to read an ETF name here.

Where can you invest in dividend ETFs?

First, it is important to find an ETF that pays dividends and that you want to invest in. Once you find an ETF, you can find a lot of information on Morningstar.co.uk, for example. Next, it is important to choose a party to invest in. You can buy dividend ETFs from DEGIRO, for example.

Tip! Read about the difference between brokers and banks and the advantages and disadvantages.

Conclusion dividend investing

Dividend investing is a great way to generate passive income as well as earn higher returns. Dividend is the profit a company pays out to its shareholders as a reward for the risk taken. You can receive dividends by investing in REITs, dividend stocks or dividend ETFs. There are several platforms where you can invest in dividend stocks and ETFs. Before you start investing, it is important to gain knowledge and understand what the risks are.