Investing at BUX Zero, how does it work?

UPDATE Aug. 3, 2022! BUX Zero; part of BUX, a Dutch app started in Amsterdam in 2014 by Nick Bortot. He first worked at BinckBank and then decided to start his own company offering investment products in the form of apps on your mobile. Easy!

Psst: Are you new to the world of investing? If so, read this article first!

Investing at BUX Zero

It is striking that the Netherlands is doing so well in terms of financial apps! Now to make sure Dutch women find their way to these apps…. And that is where ELFIN comes in… 😉

BUX’s motto is “Do more with your money.” They are giving shape to this by offering 3 types of accounts: BUX Zero, BUX X (focusing on CFD investing) & BUX C (stands for Crypto). BUX X & BUX C are more for the advanced investor. ELFIN strives, that as many women as possible get a good idea of their finances and get themselves empowered feel to start building equity. Investing at BUX Zero is thereby a great opportunity to get acquainted with the world of investing.

What can you expect from BUX Zero? A small overview:

| Easy to open account? | Yes |

| Queue to open account? | No |

| Focused on short-term or long-term investing? | Long-term is recommended |

| For investing in individual stocks? | Yes |

| For start-up investors? | Yes, but not without risk |

| Choose funds yourself? | Yes, it is possible to invest in ETFs through BUX Zero |

| Dividend funds present? | Yes |

| Good online customer service? | Good FAQ page & support email address available |

| Can I withdraw my deposit and return whenever I want? | Yes, do allow for possibly 2-3 days processing time before it is in your account. |

| Minimum deposit amount for deposits? | No |

| Minimum deposit amount for setting up monthly direct debit? | No |

| One-time deposit possible? | Yes, even through a Tag. |

| Risk profile? | Depends entirely on your own choices, but due to the smaller selection of stocks available, it quickly comes down to offensive investing anyway. |

| Cost? (these costs apply as of Aug. 3, 2022) | For US stocks:

Zero orders €0 Market orders €0 Limit orders €0 Investment plan (price per plan) €1 Fractional shares €0

For EU shares: Zero orders €0 Market orders €1.5 Limit orders €1.5 Investment plan (price per plan) €1 Fractional shares |

| Efficiency? | Depends entirely on your own choices |

| Interest on counter/savings account? | N/A. |

| Investment Plan | Yes, available for ETFs. Very easy every month automatic construction of your ETF portfolio. Costs: €1.00 per plan, regardless of how many ETFs shares. |

How does investing at BUX Zero work?

BUX Zero has been around since September 2019 and entered the market as the “first app that lets you invest for free.” That means they don’t charge a commission fee. So you pay only the cost of the share itself. This is an advantage for novice investors because when you are starting out, you are usually not investing such high amounts yet and then the commission can take a big bite out of that and snatch away returns. Cool gadget: you can transfer money directly from your account to your BUX account using a Tikkie. This makes your money available much faster to buy new shares from. At BUX Zero, you invest protected through a deposit guarantee scheme. That means you get an account at ABN Amro where your money is guaranteed up to EUR 100,000.

Investment Products

One disadvantage of BUX Zero is that it can only trade a selection of stocks from European (in between are Dutch, Belgian, German & Austrian stocks) and U.S. exchanges. View here exactly which shares they are. That does include the big players, such as Apple, Shell, Facebook, Ahold or Tesla. For a beginning investor, this is probably enough.

BUX does expand its stock offerings tremendously, and you can make suggestions as to which stocks or ETFs you would like to see in the app in the future.

You can also invest in crypt through BUX these days. This makes BUX almost the one-stop shop for the investor. Stocks, ETFs and crypto: of these categories, you will find the big names.

Read more about investing in ETFs here

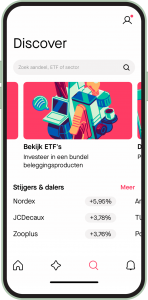

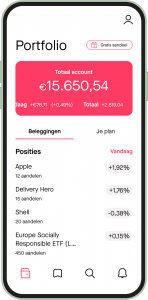

The BUX Zero app

BUX does not have a web version of their application, you only manage your investments from a mobile app. We have heard in the corridors that there will be a web version of BUX! This app is super easy to use. You transfer money to your own bank account and then you can buy a stock with just one button. The app contains little fuss and really focuses on ease of use.

On the other hand, there are few to no tools in the app to do extensive analysis. What will you find there? Your own portfolio. And you can put your shares in your “watch-list.” You can also view the Rise & Fall of the moment, search stocks by categories, e.g.. Automotive, Communication, Energy, Finance and you have an inbox where you find your notifications.

In addition, BUX Zero offers many extras to help investors with knowledge about investing, such as informative blogs and videos and a glossary to look up investment terms.

Investment Plan

Through BUX Zero, you can now set up an investment plan. Allows you to make automatic monthly investments, saves time. Choose the (fractional) stocks and ETFs you want to invest in, choose the amount you want to invest with, and BUX Zero does the rest. You can set up a monthly investment plan, containing up to ten ETFs and/or stocks of your choice, which will be executed on a predetermined day each month. Investment plans cost €1 per month, regardless of the number of stocks and ETFs included in the investment plan. If the investment plan is not implemented, no fees will be charged that month. Handy!

Fractional shares

You can also invest in fractional shares these days. That means you can buy part of a stock. Would you like Amazon in your portfolio but an entire share is too pricey? You can buy a piece of a share every month.

What does investing at BUX Zero cost?

You can currently invest commission-free at BUX Zero. You have to be careful which order you place. 3 types of orders have been introduced:

- Market order: your order is immediately executed at the current price. This is where you pay on the European market €1.50 commission fee for on equities and ETFs.

- Limit order: your order is executed at a predetermined price determined by you. Again, in the European market, you pay €1.50 commission fee for stocks and ETFs.

- Zero Order: BUX executes your order at the end of the trading day. There are no commission fees associated with this.

- Investing in accordance with an investment plan in ETFs costs €1 per transaction.

We also know the first two types of orders from other parties such as Saxo and DEGIRO. The Zero Order is unique to BUX Zero. One consequence of the Zero Order may be that the price of the stock at the end of the day is different than at the time you decide you want to buy it. This can be both positive and negative for yourself.

What is BUX Zero’s customer service like?

Ostensibly, BUX Zero is so easy that you don’t need customer service. Full sign-up, scanning your ID and verifying your information is done through the app. No more paperwork, extra bills or long waits. However, you can suggest new “wish” stocks and ETFs for their selection through the app. In addition, an online Support Center is available which also provides a Support email address.

Conclusion on investing at BUX Zero

For “simple” investing via a user-friendly app on your mobile without fuss and complicated information, BUX Zero is ideal. Be aware that this means you are not always investing commission-free and that you cannot choose every stock.

If you want a little more support and guidance, be it from an expert, be it through numbers, articles and graphs then BUX zero is not your cookie. After all, you can’t have your money invested by BUX Zero, nor do they basically help you determine what is good and what is bad for you, so if you screw it up, you screw it up. So some composure is required. Do you like to try things yourself and believe in learning by doing, then BUX Zero is totally OK. After all, we all know: you simply get the farthest when you get out of your

comfort zone

dare to step out 😉