The difference between saving and investing

Save or invest, the eternal dilemma for some. After all, will you leave your money in a savings account or will you invest it? In a savings account, it will earn you almost nothing with current interest rates, but investing again carries risks. Hmm, tricky huh? Before we can make a good choice, let’s go into a little more detail about the difference between saving and investing.

Funfact! Did you know that “saving” in a savings account is actually just another form of investing? Not? Read below to find out how!

Savings

Saving as we all know it is about putting the money you have extra and don’t use into a savings account. Technically, this is a form of investing. Because you receive interest on the amount of money you have in your savings account (during glory days, today not so much). You receive that interest as a reward because you make your savings available to the bank to invest * for example, in mortgages or consumer loans. So when you have a savings account, you are actually investing for a while.

*Source: Dutch banking association, Aegon

But if saving is a form of investing, isn’t there some risk involved?

It is indeed said that investing your money involves a certain amount of risk. However, saving through a savings account should not be placed in that category. Think of it more as an indirect form of investing. This is because when you entrust your money to the bank, it goes under a certain guarantee condition or “insurance. For example, in the case of bank failure. Now the chances of a bank going bankrupt in the Netherlands are extremely small, but it is possible. For example, if every customer of the bank suddenly decides to withdraw their savings, or a “bank run. In fact, banks have only a limited amount of money “on hand. The rest they have outstanding as loans or investments. So they cannot access that directly, and a bank can then run into payment problems.

Safetynet

Fortunately, if by chance your bank just happens to fail, you won’t lose your savings. This is because most banks operate under the Deposit Guarantee Scheme (DSG) as far as guarding your savings is concerned. This protects not only your savings but also the money in your checking account. For the wealthy among us: unfortunately, this does have a ceiling of €100,000. Before you park your money with a bank, though, always check that they are licensed with the Dutch Central Bank (DNB), as that is where DSG comes in.

Advantages/disadvantages savings account

- Availability of money in savings account: direct (up to a certain amount). For exorbitant amounts, your bank may need several business days to make this money available.

- Savings account risk profile.: Low

- Interest/profit rate: Low

Investing

Instead of putting the money in a savings account, you can choose to invest your money. You can do this actively by buying stocks, ETFs, real estate, cryptos and the like yourself, or passively through an investor account with an investment profile where experts invest for you in a variety of products.

The big difference, between saving and investing is here in the risk profile. After all, while your savings are nice and “safe” in a savings account, the money you invest in your investments is a little more subject to risk. This is because your investments can become worth more over time but also less, so you can lose money.

So what you choose depends on the trade-off you make. Are you willing to take a risk with your savings and invest it so that it becomes worth more in the long run?

Advantages/disadvantages investing

- Availability of money when invested: usually 1-3 business days, with real estate this may take a longer period.

- Investment risk profile: variable and depends on the product you choose

- Profit/loss percentage: variable and depends on the product you choose

Saving versus investing

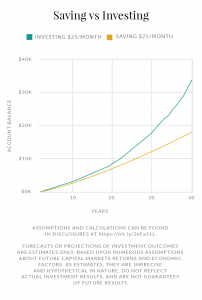

So both saving and investing are both ways to invest your money. The difference is mainly in the risk you take and the return it produces.

So isn’t saving just the best choice?

Yes, when you don’t want much to happen to your money, yes. With a savings account, you have little risk and you won’t lose money easily. On the other hand, interest rates in recent years have not been interesting enough to turn your money into more money. So a savings account is actually a “bad investment” when you are looking to increase the value of your money, or return. In addition, inflation is around 2%, which specifically means that your money in your savings account is becoming worth less.

Risk versus return

Investing your money and thereby taking on some risk pays off more. Simply because you want to be rewarded for the risk you take or actually the extra risk you take. And you want that extra risk compensated in “money,” it’s as simple as that.

Historical facts: interest rates, the stock market and inflation

If we look at the past 100 years, we also see that when you plot the savings return against the stock market, the average return achievable in the stock market was higher than that of your savings account. This has to do with risk, of course, but also with annual inflation. Goods and services are becoming more expensive, and the interest rate on your savings account is insufficient to compensate for that.

So what is the right choice now?

There actually isn’t one. Yes there is: the choice you feel most comfortable with.

Our advice is to always keep a savings account outside of investing with money you can access immediately anyway. For unforeseen expenses and times of need. So make sure and a good piggy bank, and make sure to build wealth through investing!

When choosing between saving and investing, consider the following questions: How much risk am I willing to take? Do I need the money in the short or long term? If you don’t need the money for the next 5-10 years, then investing is an interesting option in terms of return. If you know that in 1-2 years you are going to use your savings for buying a house, for example, then it is wise to keep it safe and sound in your savings account.

Whatever you choose, do so wisely.